Introduction of capital market in Finance

What is capital?

Capital market is an economic resource that is measured in terms of money used by the business peoples or by entrepreneurs to buy their needs to make their business successful. Some operations are based on capital are retail, corporate, banking, investment, etc.

What is the market?

It refers to any place where goods, currencies, bonds, shares, or other trades are exchanged between two parties. These markets are responsible for capitalist societies which provide capital formation for businesses.

Check out our latest article about the Reserve Bank Of India (RBI): History, Composition, Organizational Structure, Facts

What is meant by capital markets?

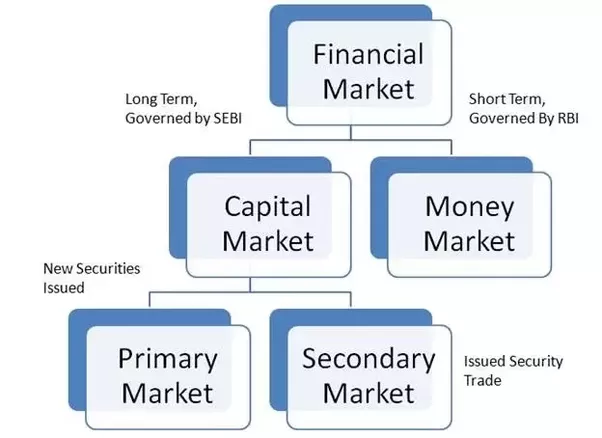

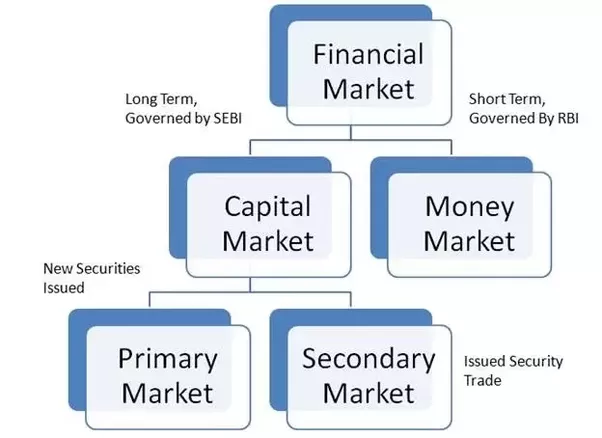

It is a part of the financial system which is used to raise funds between suppliers like people or any other with capital to lend or invest for those who are in need. capital market is highly needed for all kinds of businesses and also individuals.

The capital market is made up of primary and secondary markets. The most common example is the stock market, in which stock exchange can be done such as trading shares from stockholders or may from the companies. Their main aim is to bring together, the investors holding capital and those companies who are in seek of the capital through equity and debt instruments.

There are probably three types of capital are there: working capital, debt capital, and equity capital. The main advantage of capital markets is to generate many new opportunities like to improve in higher productivity, growth of the people, greater employment opportunities, etc.

It is also helpful in improving transactional efficiencies. Capital market is a broad term used to describe the whole financial instruments of various entities. A portion of the business sectors which are exceptionally moved in major monetary focuses in Singapore, Newyork, London, and so on.

Here mostly the funds are valued and used which is led by the suppliers and the user of funds.

Check out our latest article about the What A Consumer Needs To Know About Consumer Economics

Are capital markets the same as financial markets?

In financial markets, there is a broad range of venues where the people of the organizations will exchange their resources, protections, and different properties with each other, and in auxiliary business sectors, the capital market strategy is completed on the other hand to raise the fund which is to be used in operations for growth.

Primary Market vs Secondary Market

If new capital is raised through stocks or bonds which are issued and sold to investors is known to be the primary market, whereas traders and investors frequently buy and sell those shares among one another or with each other are known as secondary capital.

Those securities exchanged here would generally be a deep-term investment with a period of over a year. on the other way, little investments which are usually found in the capital market are shares, debt, government securities, bonds are said to be deep term investments.

The capital market always provides a platform where the funds are gained for development activities and business operations. It follows the oblique flow of money.

Mutual funds are deemed to be risky due to certain market variations. So there may also be a chance of losing money.

“ The stock market is a device for transferring all the money from the people to the people who are in want!”

Nice