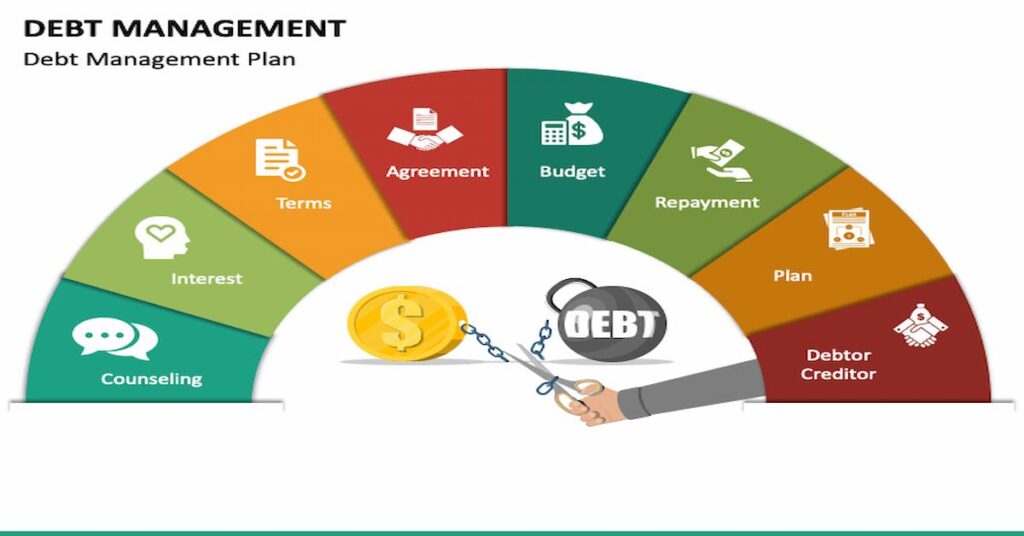

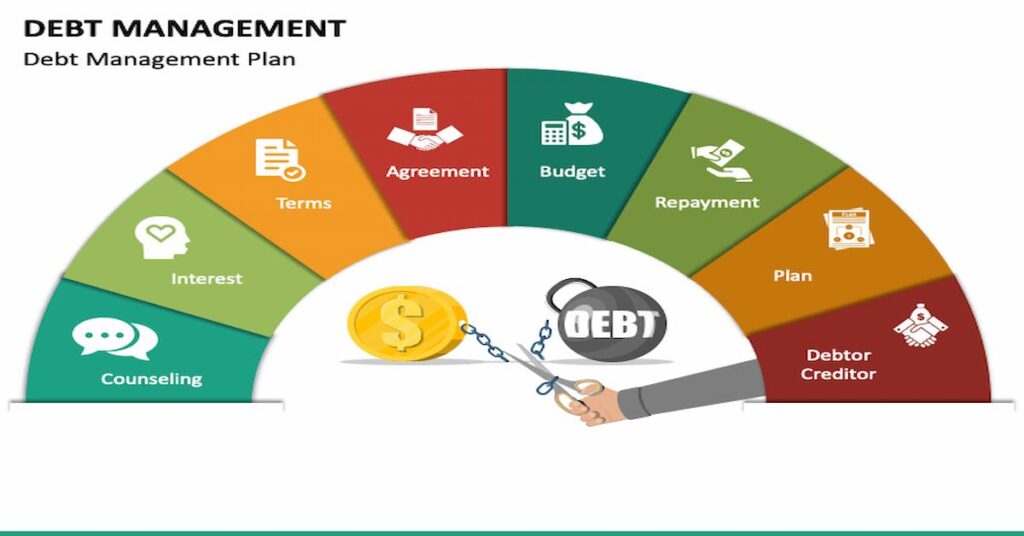

What is a Debt Management Plan (DMP)?

A plan was drafted to minimize the debt burden and ultimately eliminate it. Someone who is overburdened with debt and does not know how to get out of it needs a debt management plan (DMP).

Who can draft such a debt management plan (DMP)?

Either the debtor himself can plan for debt management with the help of a close associate/friend. Or, The debtor can seek professional advice from a credit counselor or debt manager.

The Steps that you can take to formulate a debt management plan (DMP)

- KNOW YOUR DEBT: Take a pen and paper. Write down all the debts that you owe currently. Do not forget to write the rate of interest charged. The list can be in any order. This shall help you to keep a record of them rather than all the debts scattered in your head.

- INFORM PEOPLE: A whole lot of people do not like to share that they are burdened under loans. Call it self-respect or ego, people choose not to show their weak reports no matter how much they are suffering. You must inform your family and close friends that you are in debt. Explain to them the situation you are in. This will lift a weight from your heart.

- ACCEPT HELP: This is the time to humble yourself and accept help from your people. Be it your parents, your better half, or your friends.

- NEGOTIATION: An essential aspect of a debt management plan is negotiation. You are not in a position to repay your credit card bills and other loans in time. As the days pass by, the interest keeps on building.

Hence, there must be a third party who can negotiate on your behalf. You must be wondering why a third party should negotiate for your matter. A third party shall have a neutral view of the case. He will be able to talk to the creditors (bank officials, credit card companies) level-headedly. The third party can be your friend or a credit counselor.

The types of negotiations that can be done are:

a) Reduction in interest rates.

b) Waiving off loans, and

c) Waiving/reducing the penalty fees.

Re-fixing the payment dates. FIND OTHER SOURCES OF INCOME: It would be better if you found other sources of income like freelancing.

Conclusion

You must pay for your survival needs like rent, electricity, and education. But try to limit your wants as much as possible. As you have informed your family about your financial position, ask them to cooperate, as you are trying to pay off your debts. Keep track of your expenses and keep them on tight hold.

Hi, do not stop your reading goal right here but educate yourselves in the technical aspects too. We have a tailored piece of content to make you feel at ease. Visit our article page- Calanjiyam

Calanjiyam Consultancies and Technologies.

FAQ’S

What are the steps to formulate a Debt Management Plan (DMP)?

The steps to formulate a debt Management Plan are,

Step 1: KNOW YOUR DEBT,

Step 2: INFORM PEOPLE,

Step 3: ACCEPT HELP, and

Step 4: NEGOTIATION.

What are the Disadvantages of a Debt Management Plan (DMP)?

The Five Disadvantages of a Debt Management Plan are,

1. no legal protection,

2. potential rejection by some creditors,

3. reduced credit score,

4. longer terms compared to other solutions, and

5. no debt write-off.

What are the types of Negotiations?

The Three types of negotiations are,

1. Reduction in interest rates.

2. Waiving off loans, and

3. Waiving/reducing the penalty fees.