What is a Home loan

India has a young population. Every year thousands and a lot of people join the various job sectors. They earn money and think of settling in the city of their job. They think of owning a house or a property. As we all know the price of real estate in India is soaring day by day and in this scenario, a home loan plays a crucial role in felicitating finance of the house or property. A home loan is a wise idea because owning a house or property takes a great amount of money, and nobody wants to spend all their saving or a great part of their savings on purchases like this.

Various institutions such as banks offer home loans to their customers. The good thing about taking a home loan is that its interest rate is lower than other kinds of loans. The demand for a home loan has increased manifold in recent years, and to cater to this demand banks have come up with several kinds of home loans for different kinds of people.

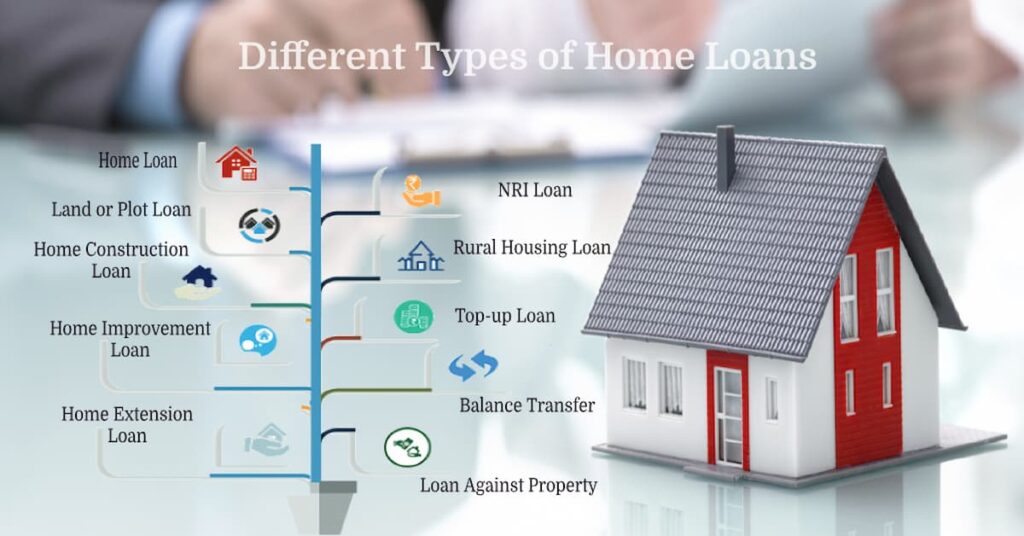

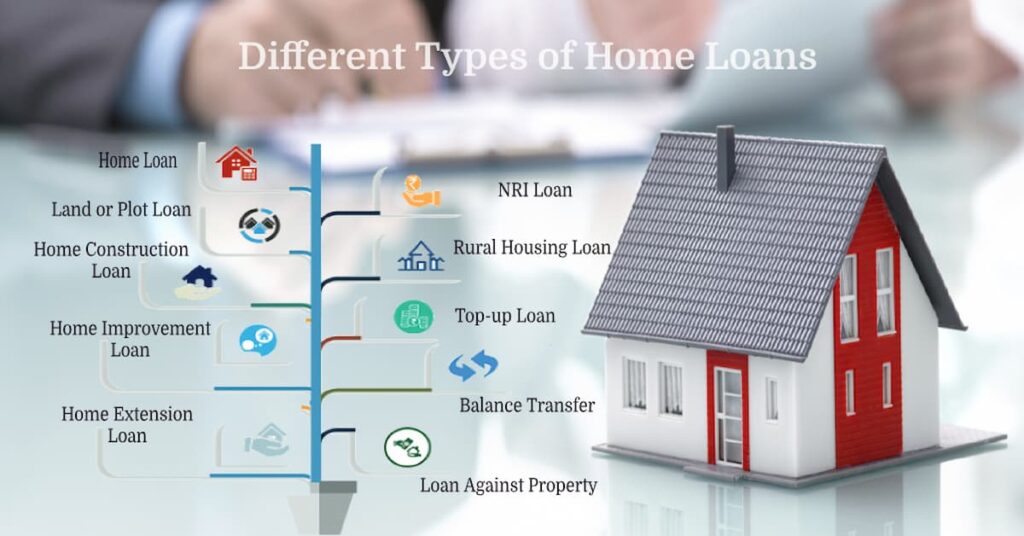

Types of Home Loans:

Financial institutions lend money not only for a home loan but for various other home-related loans.

Loans for the purchase of land

Several financial institutions offer loan services for land purchases. Purchasing land is a good option because the buyer can save money and construct a house on the purchased land whenever his finances allow him to. Up to 85% of the price of land is given as a loan to the individual.

Loans for Home Purchase

This is the most popular home loan offered by various financial institutions. An individual or a group of individuals looking to buy a house or pre-owned house can go with the home loan options available in the market. The interest rates can be a floating rate or fixed rate and generally range between 9.5% to 11.5%. 85% of the price of the home is lent by financial institutions.

Loans for the construction of a house

An individual or a group can go for this kind of loan if they have some land and want to construct a new house. This type of loan is offered to keep the price of the plot in mind. The plot must have been purchased within a year for the plot cost to be included in the loan amount. The lender estimates the cost of construction of the house before lending.

House Expansion or extension loans

This kind of loan is offered if an individual wants to expand his house such as building an extra room, balcony, or store room. Several financial institutions offer loans for the expansion and extension of homes.

Loans for home improvement

Over time your house needs improvement in construction such as painting, plumbing, electric fittings, etc. Many banks offer this kind of loan. Some of the banks are Union Bank Of India, Vijaya Bank, etcetera.

Balance transfer Home loans

If you have availed of a home loan from a bank and want to transfer it to some other bank for lower home loan interest rates, this kind of home loan comes into play.

NRI Home loans

This type of home loan is specially designed for non-residential Indians. The procedure of this loan is different from other home loans. Most banks offer this kind of loan to cater to the needs of NRIs.

FAQ’s

Is a loan good or bad?

Loans are neither good nor bad in themselves. However, loan purpose, the capacity of the borrower, the character of the borrower, loan structure, and loan terms and conditions, among other critical factors will determine whether or not a loan will turn out to be good or bad.

What is important in a home loan?

The lenders will assess your eligibility for the home loan based on your income and repayment capacity.