Introduction of financial institution

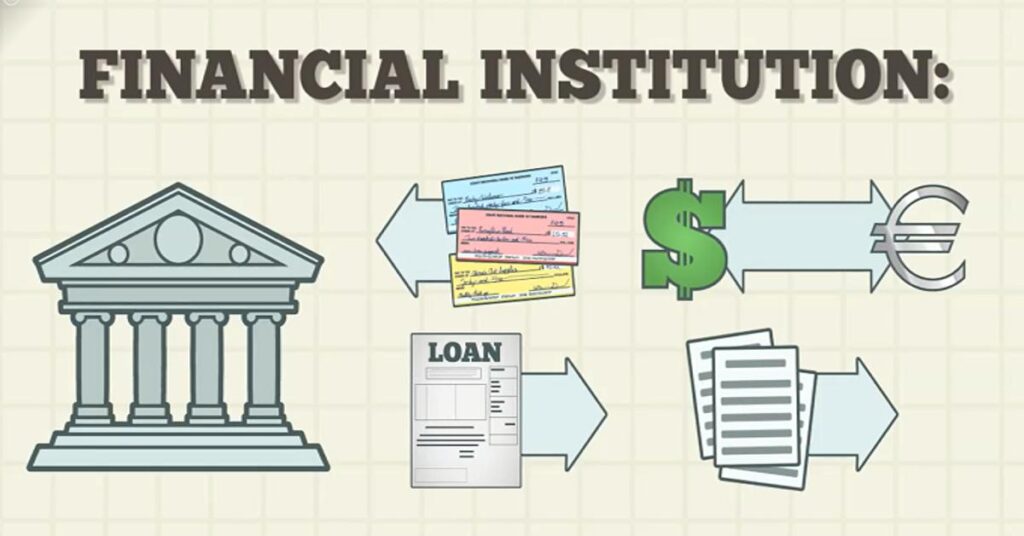

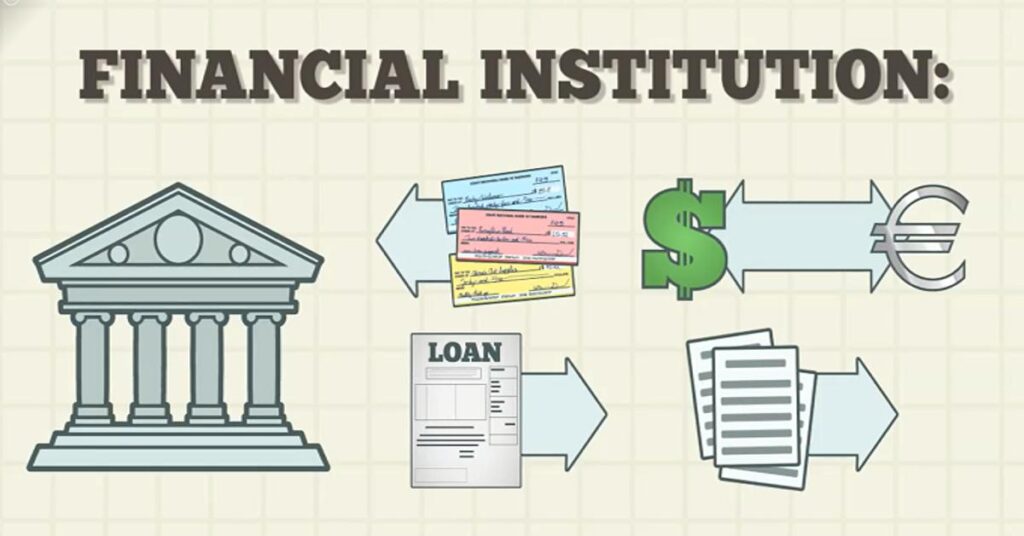

A financial institution is a registered body that serves as an intermediary for the suppliers and demanders of money in various forms. As we know today, money is required as the capital in a business, as a housing loan, like savings, as insurance premium, etcetera. Thus, money is essential that we cannot do without.

Development in a financial institution

Even in pre-independence India, people would save up for difficult times, lend money and undertake other financial transactions. But you know their amazing practices had some disadvantages/drawbacks.

For perfect example: The zamindars would charge an insane amount of interest for an agricultural loan. This often led to the farmers being bonded laborers to these zamindars.

To combat such malpractices among others, the government had to come up with an institution that had set rules and regulations, post-independence. This was done to bring the financial activities of a country under an organized head. Any created or non-industrial nation has monetary foundations as an indispensable piece of its economy. It only makes it easier for its citizens to transact, and seek help and guidance related to monetary issues.

Types of Financial Institutions

Financial institutions are of several categories and types. Nevertheless, they can be broadly classified as banking institutions and non-banking finance institutions.

In India, Banking institutions are classified as Scheduled Commercial Banks and Scheduled Cooperative Banks.

Scheduled Commercial Banks include:

- Public sector banks,

- Regional rural banks.

- Foreign banks,

- Private sector banks.

Banks perform their primary functions of accepting deposits, providing interest on deposits, lending short-term or long-term loans against mortgages, and ancillary functions like transfer of foreign exchange and keeping safety lockers for their customers.

Banks play a major role in the holistic development of an economy. It is often seen that banks provide humungous loans to priority sectors like agriculture, education, housing, small enterprises, retail trade, and infrastructure. Banks also have wealth management advisors wherein you can take advice for your mutual fund investment or the best term savings plan offered by them.

There are also investment banks that cater to all things related to stocks from the buying and selling of stocks, to mergers and acquisitions of companies. Also, they take care of all the transactions, paperwork, and compliances during an IPO (Initial Public Offering) of shares or further issue of shares.

Cooperative banks fill in the gaps in the banking needs of small and medium-income groups not adequately met by the public and private sector banks. Enhancing the endeavors of business banks, the agreeable financial framework assembles investment funds and meets the credit needs of the nearby populace. These banks are regulated and supervised by the Central bank of the country.

Non-banking financial institutions channel their deposits into capital formation by extending credit to the corporate sectors and also to the unorganized sector.

NBFCs can be classified into three segments based on the activity they undertake:

Asset Finance Company

Finances are the physical assets that are used in production activity and would add to the GDP of the economy. Manufacturing companies usually lease high-worth equipment and hire purchase large machines through the credit extended by such companies.

Investment Company

These include primary dealers who underwrite and market-making for government securities.

Loan Company

Extends loans for activities other than equipment leasing, hire purchase, and housing loans.

Then comes a type of financial institution that forms an integral part of the financial ecosystem- Developmental Financial Institutions.

There are DFIs for probably every sector so that no sector remains neglected and under-developed.

NABARD is the apex institution established to provide and regulate credit and other facilities for the promotion and development of agriculture, small scale industries, cottage, and village industries, handicrafts, and other rural crafts, and other allied economic activities in rural areas to promote integrated rural development and securing prosperity of rural areas and for matters connected therewith.

NABARD also operates various schemes including:

- Women Empowerment,

- Kisan Credit Card,

- Scheme for Financing Farmers,

- Watershed Development Scheme, and

- Rural Entrepreneurship Development Programme (REDP).

SIDBI offers services like micro-finance, project finance, venture capital, assistance for tech development, and export finance for small-scale industries.

IDFC initially focused to finance infrastructure projects like power, roads, ports, and telecommunication. But now, it has broadened its horizon to IT, integrated transportation, and food and agri-business infrastructure.